Join the Quant Scientist Newsletter

Gain access to exclusive tools that Wall Street's Elite don't want you to have. Don't miss the next issue...

Join 11,500+ Quant Scientists learning one article at a time

Join 11,500+ Quant Scientists learning one article at a time

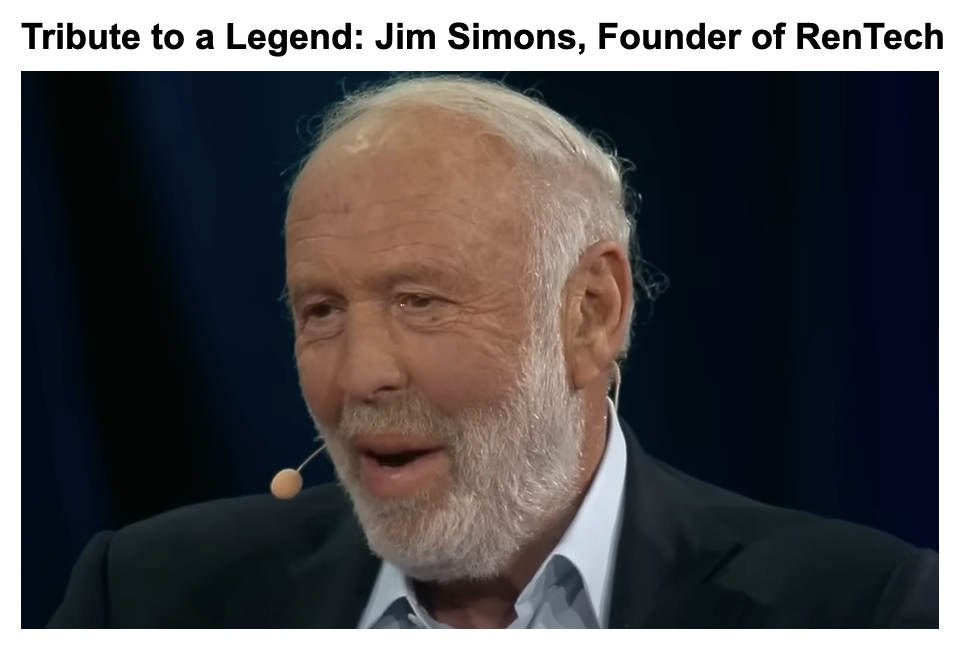

Top 5 Quant Interviews with Jim Simons (Tribute)

We're pausing our normal algorithmic trading coding session to pay a special tribute to the greatest quant of all time who recently passed. Jim Simons was the legendary founder of Renaissance Technologies (RenTech). RenTech's famous Medallion Fund has achieved a 66% average annualized return from 1988 to 2023. In this QS Newsletter, we recap the career of the legend Jim Simons with 10 videos to learn from Jim's quant wisdom.

NEW: Free 5-Day Algorithmic Trading Course

Are you interested in learning Algorithmic Trading with Python? Do you want to learn how to execute trades automatically, how to find edge, backtest trading strategies, analyze risk, then take your winning trades from Paper Account to Production (Live Trading)?

If the answer is Yes, then we have a NEW Free 5-Day Algorithmic Trading.

👉 Click here to join our free 5-Day Algorithmic Trading Course.

#1. The mathematician who cracked Wall Street | Jim Simons TED Talk Interview

To learn about Jim Simon's career going from a mathematical prodigy who was recruited by the National Security Agency (NSA) to founding Renaissance Technologies, a hedge fund know for its sophisticated quantitative trading models.

#2. James Simons (full length interview) - Numberphile

This is the full length interview (1+ hour) that covers Jim Simon's life from his academic career, defense career, transition to money management, inspiration in machine learning and finance, philosophy on mathematics and it's relationship to success in finance, and more insights from his personal life.

#3. Renaissance Technologies - Trading Strategies Revealed | A Documentary

This video covers a unique perspective on how Jim Simons built his business, RenTech, and grew it to become the most profitable hedge fund in terms of return percentage of all time. Also how RenTech had to transition from fundamental to quantitative, starting with simple mean reversion.

Number #4. Secrets of the Greatest Hedge Fund of All Time

Interview with Greg Zuckerman of the Wall Street Journal on Zuckerman's book where he conducted over 400 interview with current and former employees of Renaissance Technologies.

Number #5. The Math Equation That Beat Wall Street | Jim Simons vs. EMH (Efficient Market Hypothesis)

In this video, the efficient market hypothesis (EMH) developed by economist Eugene Fama in the 1960s, suggests that all available information is already baked into the stock asset's price. Therefore, you cannot beat the market over the long haul. This is why active manager's tend to underperform the market. A young MIT student named Jim Simons took on this challenge.

Bonus: Jim Simon's 8 market state's:

Upward Trend (Price Increasing), Volume Increasing, Low Volatility (Bull Market)

Upward Trend (Price Increasing), Volume Decreasing, High Volatility

Downward Trend (Price Decreasing), Volume Increasing, Low Volatility (Bear Market)

Downward Trend (Price Decreasing), Volume Decreasing, High Volatility

Consolidation Phase (Low Volatility)

Ranging Market (Sideways Trend with Low Volatility)

Upward Breakout (from Consolidation or Ranging)

Downward Breakdown (from Consolidation or Ranging)

Conclusions: Life of a legend

Jim Simons is an inspiration to anyone who aspires to use math to make better trading decision rather than just limiting ones self to efficient market hypothesis buy-and-hold, build quantitative trading strategies using algorithms, and actively grow investments with data and code.

Are you interested in learning active investing strategies that use algorithms to maximize returns responsibly, help you manage risk, and grow your investments? We implement 3 core trading strategies including portfolio, momentum, and spread trades that have worked in our favor in the past and continue to produce results for our students.

Learn with 200+ of us that are learning to apply python to algorithmic trading to grow investments.

Leo was up 11.5% in just 13 trading days.

Alex was waiting 9 years for a course like this:

Ready to make Algorithmic Trading Strategies that actually work?

There's nothing worse than going at this alone--

❌ Learning Python is tough.

❌ Learning Trading is tough.

❌ Learning Math & Stats is tough.

It's no wonder why it's easy to feel lost, make bad decisions, and lose money.

Want help?

👉 Join 8,200+ future Quant Scientists on our Python for Algorithmic Trading Course Waitlist: https://learn.quantscience.io/python-algorithmic-trading-course-waitlist

Start Your Journey To Becoming A Quant Today!

Join the Quant Scientist Newsletter

Gain access to exclusive tools that Wall Street's Elite don't want you to have. Don't miss the next issue...

Join 11,500+ Quant Scientists learning one article at a time

Join 11,500+ Quant Scientists learning one article at a time