Join the Quant Scientist Newsletter

Gain access to exclusive tools that Wall Street's Elite don't want you to have. Don't miss the next issue...

Join 11,500+ Quant Scientists learning one article at a time

Join 11,500+ Quant Scientists learning one article at a time

Factor Analysis in Python (with Alphalens)

Python is insane for finance! Case in point: Factor Analysis in Python (with Alphalens). In this QS Newsletter (get the code), we are sharing some of the insane functionality you get inside this awesome Python package, Alphalens. Today, you learn:

What Alphalens is (and why it's important for Factor Analysis)

Full tutorial: How to do Factor Analysis with alphalens

BONUS: Get the Python Code for EVERYTHING you see in this post

Disclaimer:

The information and educational material provided by Quant Science, LLC are for educational purposes only and should not be considered as financial advice or recommendations to purchase, hold, or sell any securities or other financial instruments. Before you proceed, please review our full disclaimer here.

Join the Quant Scientist Newsletter (and Get the Code)

Want exclusive access to our FULL codebase for this Quant Science tutorial plus dozens more? The code is in the QS015 Folder. Join here:

NEW: Free 5-Day Algorithmic Trading Course

Are you interested in learning Algorithmic Trading with Python? Do you want to learn how to execute trades automatically, how to find edge, backtest trading strategies, analyze risk, then take your winning trades from Paper Account to Production (Live Trading)?

If the answer is Yes, then we have a NEW Free 5-Day Algorithmic Trading.

👉 Click here to join our free 5-Day Algorithmic Trading Course.

What is Factor Analysis?

Factor analysis is a statistical method used to describe variability among observed, correlated variables in terms of a potentially lower number of unobserved variables called factors. It helps to identify underlying relationships in data by finding a way to condense the information contained in many original variables into just a few derived factors without losing significant information.

Applications in Finance

In the context of finance, factor analysis is typically used to identify factors that can explain patterns of returns on stocks, bonds, or other financial assets. These factors could be macroeconomic factors (like GDP growth rates, interest rates, inflation) or asset-specific factors (like market capitalization, price-to-earnings ratios, dividend yields).

Risk Management and Portfolio Construction: Factor analysis helps in understanding the risk exposures of assets to various economic and market factors. By understanding these exposures, portfolio managers can construct a portfolio that aligns with a specific risk profile and investment strategy.

Performance Attribution: Understanding which factors contribute to the performance of a portfolio can help managers explain results to investors, refine their strategies, and manage risks more effectively.

Strategic Asset Allocation: By analyzing the factors that drive asset returns, investors can make informed decisions about asset allocation, choosing to invest in asset classes or individual securities that align with desired factor exposures.

Factor Analysis is used by Hedge Funds

Hedge funds extensively use factor analysis to enhance their investment strategies. Here’s how:

Identifying Alpha: Hedge funds use factor models to separate returns attributable to broad market movements (beta) from returns attributable to individual asset selection (alpha). This helps them focus on generating returns through skill rather than market movements.

Style Analysis: Factor analysis enables hedge funds to analyze the style and strategy of their investments (value vs. growth, small-cap vs. large-cap, etc.) and adjust their exposures accordingly.

Risk Factor Modelling: By identifying key risk factors, hedge funds can hedge against potential downturns that are predicted based on those factors, thus managing potential losses more effectively.

Quantitative Trading: Quantitative hedge funds use factor models to develop algorithmic trading strategies that automatically adjust to changing factor exposures and market conditions.

What is Alphalens (and why is it important for Factor Analysis)?

Alphalens is a Python library for performance analysis of predictive (alpha) stock factors. It is designed to help quant analysts and portfolio managers to evaluate the effectiveness of different alpha factors for stock selection. The library integrates well with other Python tools used in quantitative finance such as pandas, NumPy, and SciPy, and it is often used in conjunction with backtesting libraries to assess potential trading strategies using Zipline.

Key Features of Alphalens

Factor Analysis: Alphalens allows users to analyze the predictive performance of their alpha factors on stock returns. This includes calculating various statistics that help in determining how much a factor can be expected to contribute to a trading strategy's performance.

Returns Analysis: It can compute forward returns for stocks based on various factors, allowing for an assessment of how well a factor predicts future prices.

Information Coefficient (IC): Alphalens can calculate the IC, which measures the rank correlation between factor values and subsequent returns, providing a statistical measure of a factor’s predictive power.

Quantile Analysis: The library enables users to break down the factor data into quantiles to analyze how stocks behave relative to different factor values. This helps in understanding whether high or low values of a factor lead to better or worse future performance.

Turnover Analysis: Alphalens examines the turnover of factors, which is essential for understanding the trading costs associated with a strategy that uses the factor.

Integration with Portfolio Construction: While Alphalens itself does not build portfolios, it provides essential data that can be used for portfolio optimization in other libraries like Pyfolio, Zipline, or custom-built optimization frameworks.

Full Tutorial: How to do factor analysis with Alphalens

Ok, let's dive in and see what you can do with Alphalens. First, make sure to sign up for our Newsletter to get all of the code you see today.

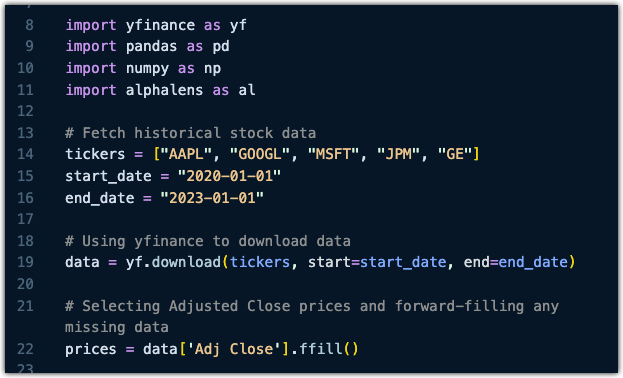

Step 1: Download Stock Data from Yfinance

Next, run this code from the "QS015-alphalens" Folder:

This code downloads the stock assets that we'll analyze in a quick factor analysis.

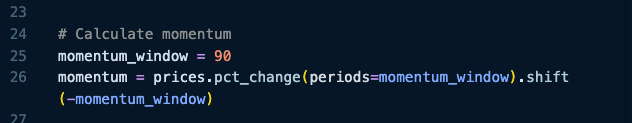

Step 2: Make one or more factors

This is where you'll implement your factor(s). Here we do a simple price change over last 90 days, which is a very basic momentum factor. This factor will be used to score our universe of stocks to determine which are the best and worst investments. Run this code:

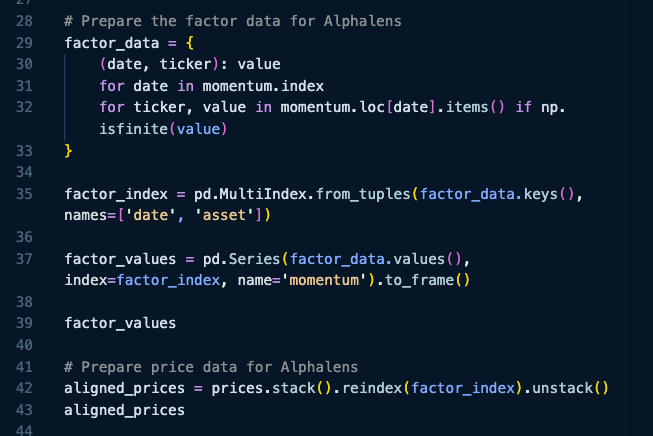

Step 3: Prepare the factor data and prices for Alphalens

Next, we need to prepare 2 input datasets for the factor analysis:

Factor Values: A data frame with one column containing the factor (momentum column) and an index of the date and asset (stock)

Aligned Prices: This is the asset (stock) prices in columns with the index aligned to the date of the factor values.

Run this code:

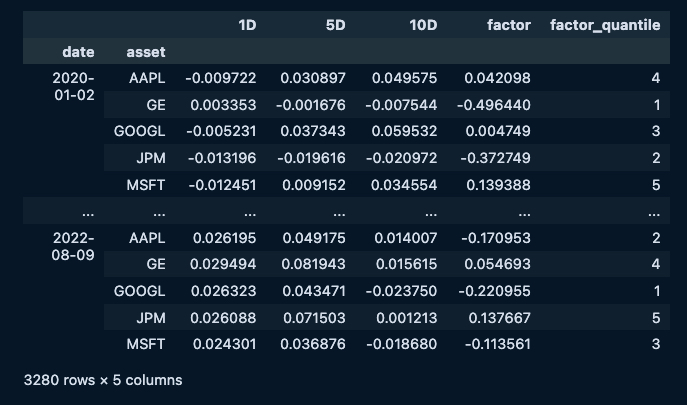

Here's what the factor values and aligned prices should look like:

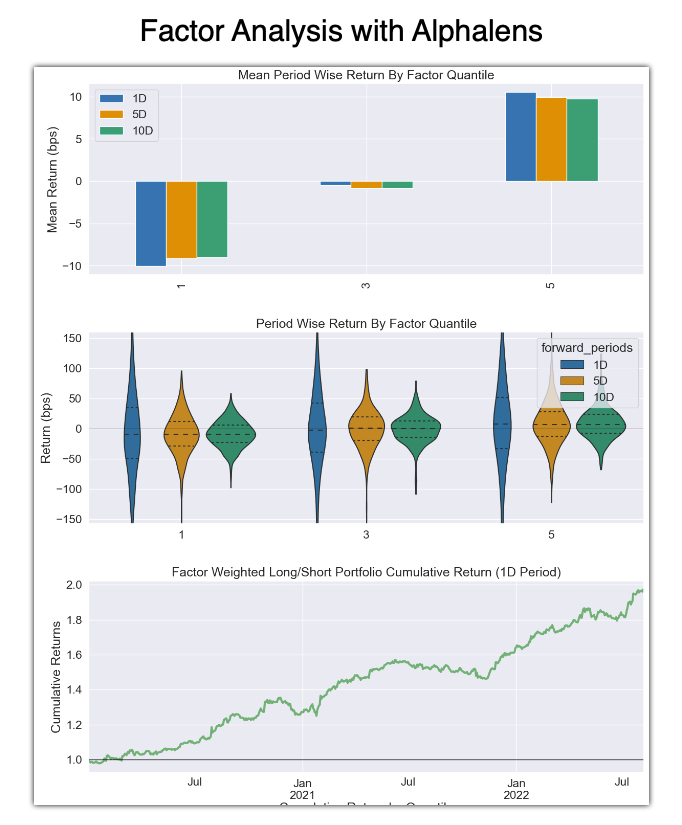

Step 4: Run the Factor Analysis with Alphalens

Now we are ready to use the magic of alphalens to run our factor analysis. Run this code:

This produces a data frame of returns for each of the stocks over the next 1, 5, and 10 days along with the factor value and the factor quantile ranking (5 is best and 1 is worst).

Step 5: Analyze your factors

Alphalens has a ton of functionality for analyzing factors. The best functionality is the Tear Sheets. Run this code:

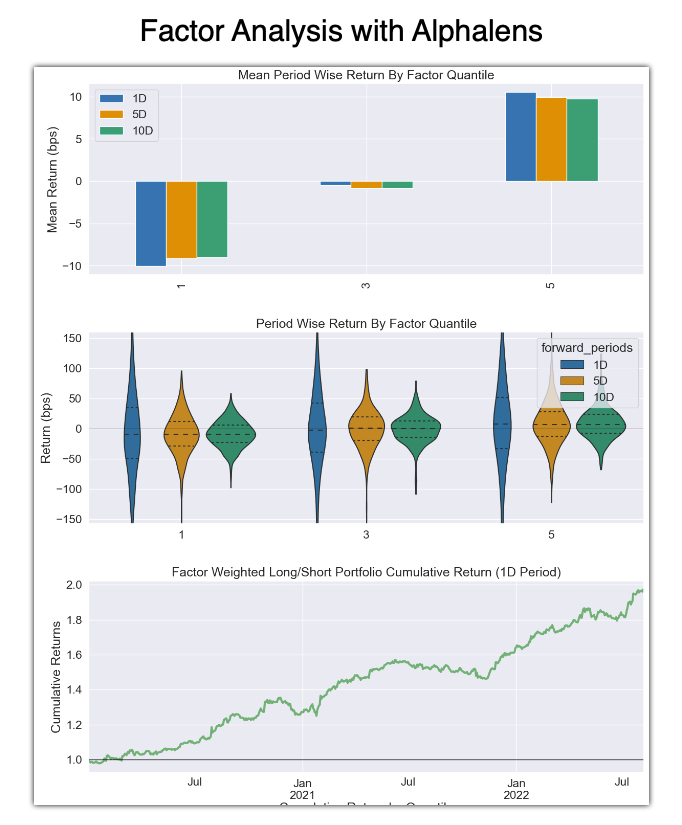

...And here's the power of alphalens for factor analysis:

Conclusion: Alphalens for Algorithmic Trading and Factor Analysis

Python is wild for finance. It's hard to believe these tools are available for free. Alphalens is insane for Factor Analysis.

But having access to the tools doesn't guarantee results. You still need to:

Generate trading strategies

Backtest strategies

Execute trades

You can go at it alone. Or you can learn with 200+ of us that are learning to apply python to algorithmic trading to grow investments.

Leo was up 11.5% in just 13 trading days.

Alex was waiting 9 years for a course like this:

Ready to make Algorithmic Trading Strategies that actually work?

There's nothing worse than going at this alone--

❌ Learning Python is tough.

❌ Learning Trading is tough.

❌ Learning Math & Stats is tough.

It's no wonder why it's easy to feel lost, make bad decisions, and lose money.

Want help?

👉 Join 8,200+ future Quant Scientists on our Python for Algorithmic Trading Course Waitlist: https://learn.quantscience.io/python-algorithmic-trading-course-waitlist

Start Your Journey To Becoming A Quant Today!

Join the Quant Scientist Newsletter

Gain access to exclusive tools that Wall Street's Elite don't want you to have. Don't miss the next issue...

Join 11,500+ Quant Scientists learning one article at a time

Join 11,500+ Quant Scientists learning one article at a time